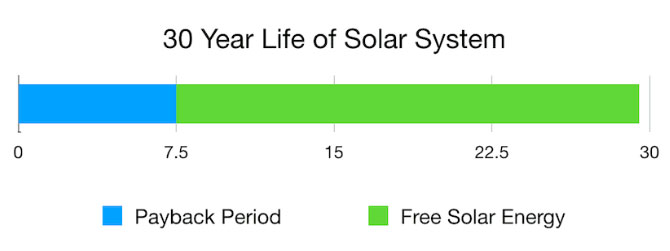

Buying solar panels isn’t just a purchase; it’s an investment. The payback period tells you when that investment stops costing you money and starts saving it. For many homeowners and businesses in Pakistan, the payback period decides whether solar is attractive right now, or something to postpone. In this guide, I’ll explain the real drivers of payback, show practical calculations for common system sizes, and point out policy and technical details that can speed—or slow—your recovery of costs.

What is the solar payback period? (simple definition)

The payback period is the number of years it takes for the cumulative savings from your solar system (reduced electricity bills, net-metering credits, avoided fuel for generators) to equal the system’s upfront cost. Put another way: after the payback period, electricity generated by your system is effectively free.

Key variables that determine the solar payback period

Before we crunch numbers, you should know the main inputs that shape payback:

- System cost (PKR) — panels, inverter, mounting, wiring, installation, permits. Recent market ranges for a 5kW system in Pakistan vary widely (roughly PKR 650,000–950,000 depending on components and whether batteries are included).

- Annual generation (kWh/year) — depends on system size, location, and panel efficiency. A 5kW rooftop typically produces in the range 6,000–8,500 kWh/year, depending on site and losses.

- Electricity tariff (PKR per unit) — the higher your effective tariff, the faster your payback. National and regional tariffs vary; different data points in 2025 show projection figures around PKR 25/unit (PPP) to consumer bills averaging PKR 34–45/unit depending on DISCO and slab.

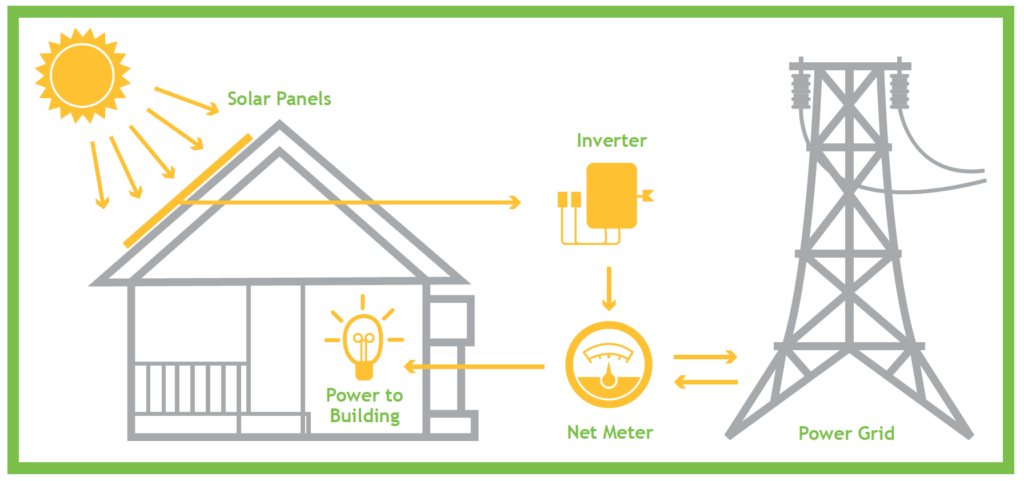

- Self-consumption & net metering — how much of the solar output you use directly versus how much you export (and at what credit rate). Net metering historically shortened payback to 2–4 years for many residential systems.

- Operational costs & degradation — cleaning, inspections, and the gradual loss of panel output (typically ~0.5% per year).

Realistic example: How I calculate solar payback period for a 5kW rooftop system

Let’s run a clear, conservative example using three scenarios (low/medium/high) so you can see how different inputs change the outcome. (I’m showing round numbers to keep this practical.)

Assumptions:

- Annual generation (5kW): 7,800 kWh/year (≈650 kWh/month average).

- System cost scenarios: PKR 650,000 (low) / PKR 800,000 (mid) / PKR 950,000 (high).

- Tariff scenarios: PKR 25/unit (low) / PKR 35/unit (mid) / PKR 45/unit (high) — representing different DISCOs and bill slabs.

Annual savings = annual generation × tariff.

Using those numbers:

- If you pay PKR 35/unit (mid case), annual savings = 7,800 × 35 = PKR 273,000.

- Payback = cost/savings:

- Low cost: 650,000 / 273,000 ≈ 2.4 years.

- Mid cost: 800,000 / 273,000 ≈ 2.9 years.

- High cost: 950,000 / 273,000 ≈ 3.5 years.

- Payback = cost/savings:

- If the tariff is PKR 25/unit, the same system’s payback stretches to roughly 3.3–4.9 years across the cost range.

- If tariff is PKR 45/unit, payback tightens to roughly 1.9–2.7 years.

These ranges match independent market analyses showing many residential net-metered systems in Pakistan had paybacks in the 2–4 year range before policy adjustments.

Takeaway: small changes in tariff or in the system cost change payback materially. That’s why shopping around and asking for detailed yield estimates matters.

Why net metering and export rules matter

Net metering lets prosumers (producer-consumers) offset nighttime or low-sun consumption with credits earned during the day. Historically, this policy shortened payback periods dramatically for rooftop systems because exported energy was credited at near retail rates. IEEFA’s analysis found that under the original net-metering framework, many 5–25kW systems had 2–4 year paybacks.

But policy moves in 2025–2026 (discussion of lowering buyback rates and revising settlement methods) threaten to change the math; proposed cuts in buyback tariffs could lengthen paybacks unless households use more of their solar on-site. Recent reporting notes government plans to reduce buyback rates substantially to reduce cross-subsidy pressures—this is a live policy risk you should factor in when modeling payback.

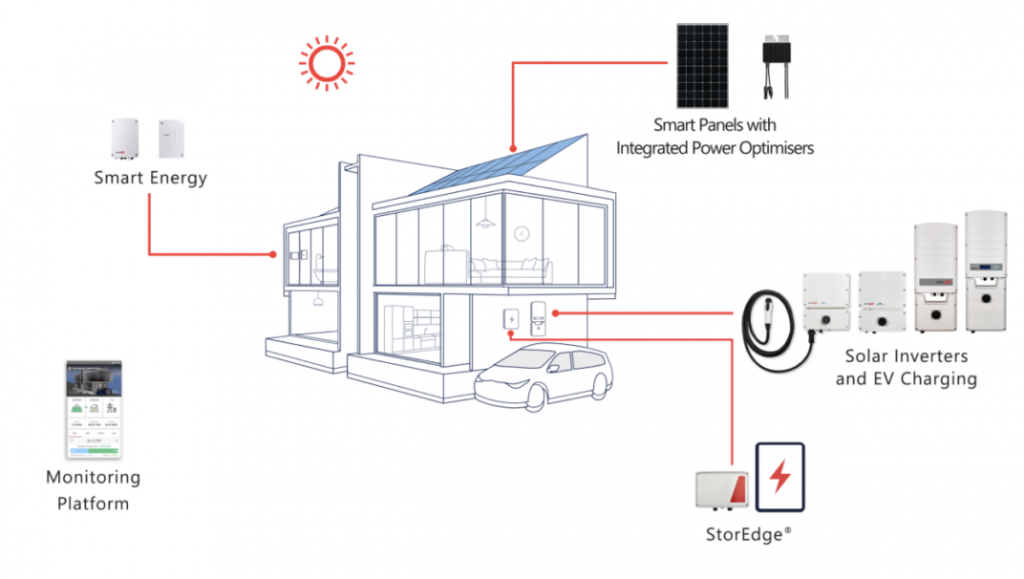

How system size and storage change the picture

- Larger systems tend to enjoy shorter payback periods per kW because balance-of-system (BOS) costs scale sub-linearly; a 25kW commercial installation can pay back faster than a 5kW home system if most generation is self-used. IEEFA analysis supports this: larger systems often report shorter paybacks.

- Batteries add resilience and let you increase self-consumption, but they raise upfront cost and can lengthen nominal payback unless you value backup power or can arbitrage time-of-use rates. In markets with frequent load-shedding (like many Pakistani cities), batteries can make practical sense despite longer pure financial payback. See developer examples where adding storage changes payback dynamics.

Hidden costs and realistic allowances

Don’t forget these when you calculate payback:

- Mounting and roof work (structural upgrades if needed).

- Net-metering application fees and meter changes (utility processing).

- Maintenance and cleaning (dust in Pakistan reduces yield; simple cleaning can return lost output).

- Inverter replacement (inverters often need replacement once in 10–15 years).

When installers quote “payback”, ask what assumptions they used: tariff level, percent self-consumption, panel degradation, and whether batteries were included.

Practical steps I recommend (how to get an accurate payback for your roof)

- Get a site-specific yield estimate — not just “5kW produces X kWh”. Good installers model orientation, shading, and temperature losses.

- Use realistic tariffs — check your latest bill for the actual per-unit rate you pay; don’t assume averages.

- Model self-consumption — shifting some loads to daytime (geyser schedules, washing machines) improves payback.

- Ask about net-metering treatment — will your export be credited at the retail rate, or at a lower buyback? Policy is shifting; confirm current practice.

- Compare multiple quotes and warranties — small differences in inverter quality or panel degradation translate into years on payback.

Conclusion — when will you see savings?

There’s no single answer: under current market conditions, a typical 5kW rooftop system in Pakistan often pays back in roughly 2–4 years if you maximize self-consumption and net-metering credit; in lower-tariff or export-unfriendly scenarios, that window can extend to 4–6 years. The most important control you have is the amount of solar you use directly during the day, and the accuracy of the yield estimate you base your decision on.

If you want an honest, site-specific solar payback period estimate (no fluff), we at JS Technology can model your roof, run tariff scenarios, and show exactly when your system will pay itself off — and what your savings look like year by year.

References & sources

- Market price ranges for 5kW systems. alphasolar.com.pk+1

- IEEFA analysis on net-metered payback ranges. IEEFA

- NEPRA/energy tariff projections and reporting. newzshewz.com+1

- Reporting on policy shifts and buyback proposals. Arab News+1

- Local installer ROI examples and market pages. Apex Holding+1

Frequently Asked Questions

- Q: How long does a 5kW solar system take to pay back in Pakistan?

A: Typical estimates range from 2–4 years for net-metered systems, but exact payback depends on your tariff, rooftop yield, and self-consumption. - Q: Will a lower buyback rate affect my solar payback period?

A: Yes—if exported units are credited at a lower rate, payback can lengthen unless you increase daytime self-use. Policy changes have been proposed that could affect buyback rates. - Q: Does adding batteries improve the solar payback period?

A: Batteries increase resilience and daytime self-use, but they add cost. In some cases, they improve practical value, though they may extend pure financial payback unless you can use stored power at high tariff hours. - Q: What’s the most important factor to speed up payback?

A: Maximize daytime self-consumption (run heavy loads in peak sun hours) and choose a reputable installer who models real yield. - Q: Can JS Technology provide a payback report for my house?

A: Yes — we run a site audit, model expected yield, and present multiple tariff and battery scenarios so you can see realistic payback timelines. Contact us for a free consultation.